There’s a common misconception that if you want to capture innovation capital, you need to be based in one of a handful of (largely coastal) tech hubs—especially in the United States.

After all, when you look at the cities whose companies regularly rake in the most angel investment and venture capital (VC) funding, the same major metros (Silicon Valley, Boston, LA, New York City) continually take the top spots.

To that end, the businesses being born out of San Francisco and San Jose are on a decade-plus roll, with more than 400 funding rounds valued at a combined $18 billion-plus tracked here during Q2 2024 alone. This total even made Boston—number 3 in the ranking in the country’s VC rankings—look modest in comparison, with 71 rounds worth almost $2.2 billion tracked over the same period.

If there’s anything that the business world has learned since the pandemic fundamentally shifted the ways we work, however, great ideas (and great talent) aren’t limited to just a handful of zip codes.

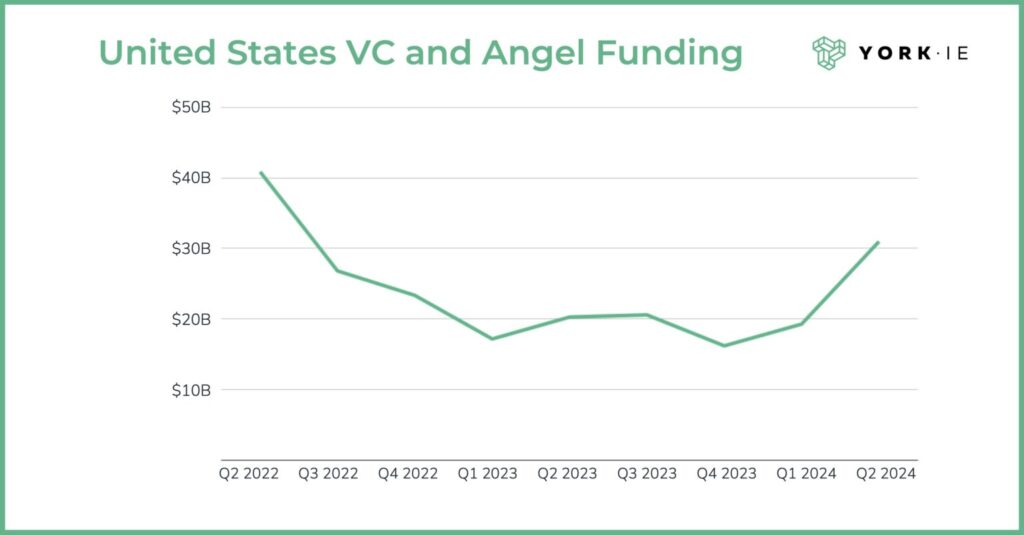

As the team at York IE recently uncovered, startup funding was being captured in unexpected corners of the United States throughout Q2 2024, helping push angel and VC funding totals up 61 percent from Q1.

“Heading into 2024, we expected to see the markets open back up in the second half of the year,” said Joe Raczka, chief investment officer, York IE. “That timetable is now accelerating, as more startups in both traditional and emerging hubs are securing the capital they need to build successful businesses.”

A boost in Q2 VC funding driven by Tier 2 cities

When zeroing in on the metropolitan areas where the growth was the most significant quarter-over-quarter, a few of the usual suspects were prevalent. This included big rebounds for businesses in New York City and San Francisco after a lackluster Q1—not to mention a blockbuster $6 billion Series B for xAI that “lifted all ships” in Silicon Valley’s valuations for Q2.

Many of the largest gains, however, were in smaller metros that don’t share the reputation for innovation that you may commonly associate with VC interest.

Provo, Utah, for instance, saw a 587 percent growth rate in funding over Q2, tallying $235,712,926 across 12 rounds. While this is a far cry from the hundreds of rounds that Silicon Valley businesses witnessed over the quarter, the Provo metro area is punching way above its weight in terms of driving innovation per capita (ie. a metro population of just over 800,000 compared to almost 8 million in San Francisco).

Most importantly, the nature of the businesses that pushed Provo to the top spot indicate that this isn’t a flash-in-the-pan phenomenon. Renewable energy startup Torus, for instance, raised $67 million in Series A funding, while Zanskar, a geothermal energy company saw a $30 million Series B over the Quarter. This demonstrates an early interest in cleantech and greentech businesses that are carving increasingly successful niches outside of the traditional coastal tech hubs over consecutive quarters.

In a similar vein, the success of Cincinnati (#2) and Baltimore (#3) are showing that investment in healthcare innovation is not only on an upswing broadly, but is coming out of think tanks and institutions outside of the Boston and NYC metros that historically see the bulk of healthcare-VC interest. In both Cincinnati and Baltimore, healthcare businesses saw strong Series A and Series B investments that accelerated their momentum over the quarter, while cities like Minneapolis, Philadelphia and Milwaukee saw similar investment trends.

Cleantech, Biotech regaining momentum in Q2

In fact, while artificial intelligence (AI) in all of its iterations gets the lionshare of headlines around VC funding, cleantech and biotech businesses enjoyed significant funding and attention during Q2 that directly lifted investment totals across the United States.

It also shows that investors are increasingly focused on disturbing traditional sectors and industries.

At many of the businesses that enjoyed huge rounds in Q2, their products were deeply rooted in research and development that applies new technologies and approaches to derive net-new products and services.

While not listed in York’s Q2 ranking, Detroit, for instance, has made global headlines as startups based here transform the car industry that has defined the city for more than a century. Pitchbook reported that total VC funding in Q2 topped $79 million as renewables, battery and manufacturing startups take advantage of the metro’s existing heavy-industry infrastructure, but with an eye toward the future.

By prioritizing innovation and digging deep into R&D, businesses like these can identify whitespace in the market, create complementary products, and even unlock non-dilutive funding that can extend their product runway.

Boast partners with hundreds of innovative businesses throughout the US and Canada to help seamlessly claim their share of this massive funding opportunity to fuel growth. To learn more about how Boast can help you seamlessly tap into his critical funding, talk to an expert today.

United States Startup Cities FAQ

- Which cities are seeing the fastest growth in startup funding in the US? While traditional tech hubs like Silicon Valley, Boston, LA, and New York City still lead in overall funding, smaller metros are showing significant growth. Notably:

- Provo, Utah saw a 587% growth rate in funding over Q2, with $235,712,926 across 12 rounds

- Cincinnati and Baltimore also showed strong growth, particularly in healthcare innovation

- Other emerging hubs include Minneapolis, Philadelphia, and Milwaukee

- How did Q2 2024 compare to Q1 in terms of startup funding? Q2 2024 saw a significant increase in startup funding:

- Angel and VC funding totals were up 61% from Q1

- Traditional hubs like New York City and San Francisco rebounded after a lackluster Q1

- Silicon Valley benefited from a blockbuster $6 billion Series B for xAI

- What industries are driving growth in these emerging startup hubs? Key industries showing strong growth include:

- Cleantech and renewable energy (e.g., Torus and Zanskar in Provo, Utah)

- Healthcare and biotech (particularly in Cincinnati and Baltimore)

- AI continues to attract significant funding across various locations

- How does the growth in smaller metros compare to traditional tech hubs? While traditional tech hubs still lead in total funding, smaller metros are “punching above their weight” in terms of innovation per capita. For example:

- Provo, with a metro population of about 800,000, saw significant growth compared to San Francisco’s population of almost 8 million

- Emerging hubs are attracting substantial Series A and B investments, particularly in healthcare and cleantech

- What opportunities exist for startups outside of traditional funding hubs? Startups outside traditional hubs can:

- Focus on disturbing traditional sectors and industries through innovative R&D

- Tap into over $20 billion in innovation capital offered by local and national governments across North America

- Leverage non-dilutive funding options to extend their product runway without giving up equity

- Partner with experts to identify and claim their share of available funding opportunities